tax on unrealized gains uk

Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law. How are capital gains taxed in UK.

The Capital Gains Dilemma Northern Trust

Work out your total taxable gains.

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

. In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with Bitcoin also come to mind. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

Deduct your tax-free allowance from your total taxable gains. Corporate - Income determination. Bidens tax on unrealized gains will hit far more taxpayers than he claims by Isabelle Morales opinion contributor - 051322 430 PM ET The views expressed by.

Tax on unrealized gains uk Thursday March 3 2022 Edit. If the proposal were. If you decide to sell youd now have 14 in realized capital gains.

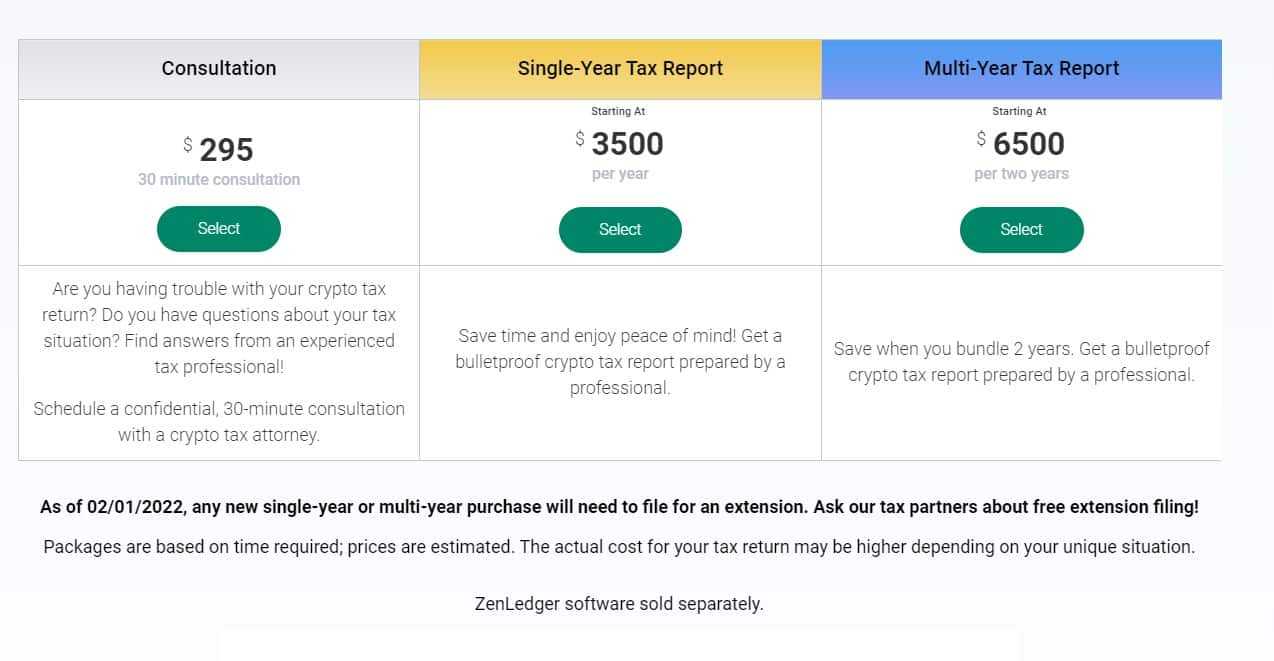

Well pair you with a certified accountant who can chat through your questions and options. Last reviewed - 27 July 2022. Total profits are the aggregate of i the.

Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires. The tax laws include a 0 tax bracket on long-term capital gains up to a certain amount of total income. For example if you were.

Add this amount to your taxable income. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more. If youre single and all your taxable income adds up to 40000 or less in 2020 then.

Tax Implications of Unrealized Gains and Losses. A UK resident company is taxed on its worldwide total profits. A capital gains tax is a levy on the profit that an investor makes.

Under the proposed Billionaire. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

Tax Advantages For Donor Advised Funds Nptrust

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

Crypto Tax Free Countries 2022 Koinly

Cryptocurrency Accounting On The Financial Statements M I

Best Crypto Tax Software Top 7 Tax Tools In 2022 Complete List

Looking Back On Taxation Of Capital Gains Mark To Market Means To Pay On Unrealized Capital Gains Annually Stock Market Stock Market Quotes Capital Gain

Cryptocurrency Accounting On The Financial Statements M I

Crypto Tax Free Countries 2022 Koinly

Coty Profit Momentum Continues In Q3 Delivering Early Results Across Brand Portfolio Coty Com

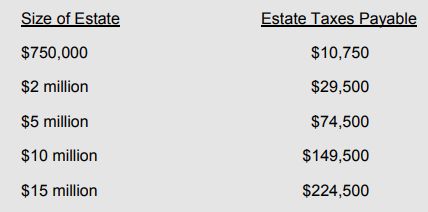

Planning To Minimize Estate Taxes Under The Estate Administration Tax Act 1998 Ontario Wills Intestacy Estate Planning Canada

Profit And Loss P L Statement Template Download Free Template

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

Can You Avoid Capital Gains Tax If You Reinvest Quora

Long Term Capital Gain Tax Calculator In Excel Financial Control

Coty Profit Momentum Continues In Q3 Delivering Early Results Across Brand Portfolio Coty Com

Cryptocurrency Accounting On The Financial Statements M I

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)